Tax Made Simple,

Service Made Personal

Say goodbye to HMRC headaches. At FBTC, we make tax compliance easy, efficient, and stress-free—so you can focus on what matters most

Simplicity Made Easy

Clear, hassle-free processes to make your tax journey stress-free.

All-in-One Support

Comprehensive services and MTD-compliant software—all in one place.

Affordable Pricing

Flexible monthly plans to suit your budget.

35+ Years of Expertise

Trusted by thousands with decades of experience to back it up.

Making Tax Digital just

got even easier

Learn about the essentials of Making Tax Digital (MTD), how it works, and key compliance dates based on your income level.

- Set up an account

- Upload your transactions

- We handle the rest!

Our services

Professionally produced tax returns

Expertly compiled annual accounts and tax return, guiding your business through continually changing tax legislation.

All communications with HMRC

Our specialist team is always in your corner, and will resolve any issues you may have with HMRC.

Mortgage and rental references

We will complete mortgage or rental references on your behalf, should you ever require one.

Self-Employment Registration

We will register your self-employment with HMRC.

Tax planning advice

Our expert team will guide you through the tax year with personalised tax planning advice as and when needed.

Help and support

Our experts are available 9am–5pm, Monday to Friday.

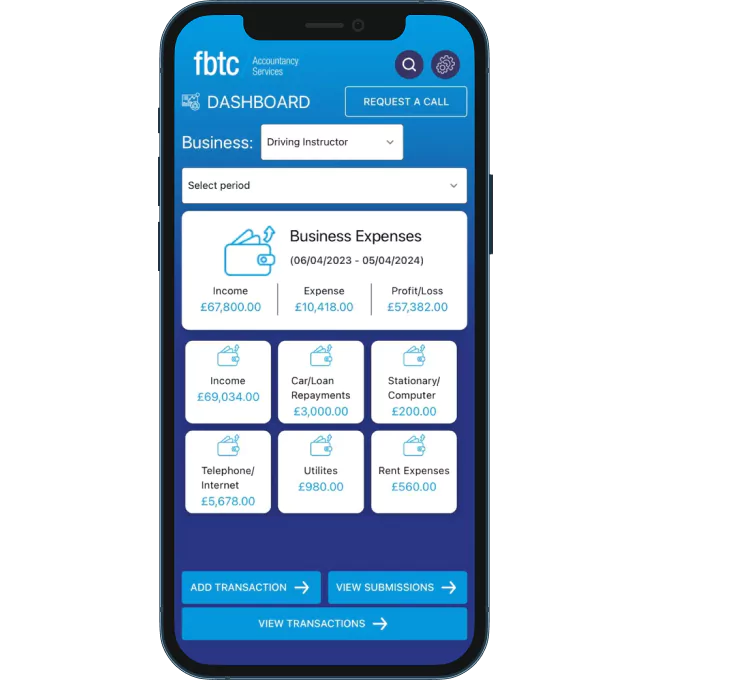

A dedicated client portal so you can focus on your business

FBTC has a client portal that allows clients to view and sign their tax documents quickly and easily.

Pocket-Friendly

Prices

We offer exceptional service at an affordable monthly fee, allowing you to spread costs over the year. This flexible approach helps you manage your budget while enjoying our full range of services.

Membership Package

£32.50 Per Month

Best for sole-traders

Features:

-

Registering your business with HMRC

-

Guiding you through the tax years

-

Completing and submitting tax returns on your behalf

What our

clients say

“The best! Extremely helpful, knowledgeable, understanding, kind and thorough. Would never use anyone else and have suggested to others to go on board with them.”

Lynn

Self-Employed Driving instructor

All-in-One Service

We are here to support you every step of the way, especially compliant software to ensure you are ready for the mandating of Making Tax Digital.

Need some advice, top-notch support, or a little reassurance?

We can provide it all. With over 35 years in the game, we know our stuff and we’re here to help you out.